Guardianship Authority

Presidency of the

Council of Ministers

Lebanon, with its official non-interventionist stance toward private investments, offers one of the most liberal investment climates in the Middle East. The openness of the country is harnessed through the absence of legal restrictions on the entry or exit of firms, encouraging free market competition and furthering the development of the private sector. Lebanon’s low corporate tax rates and competitive taxation scheme have also played a defining factor in channeling investments to the country. The country’s ability to manage and mitigate external risks, successfully averting the negative repercussions of the last global economic downturn and regional disturbances is attributed to its highly liquid banking sector considered the backbone of the Lebanese economy, and offering investors the security needed through its Banking Secrecy Law.

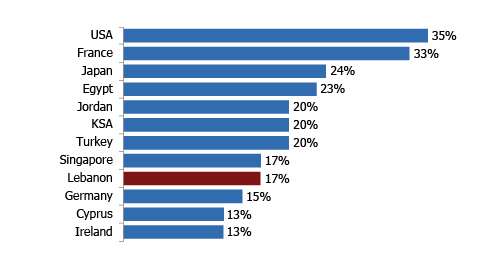

Lebanon boasts one of the lowest corporate income tax rates in the world, which has played a defining role in channeling investments into the country.

CORPORATE TAX RATES (2017)

Source: Countries' Investment Promotion Agencies

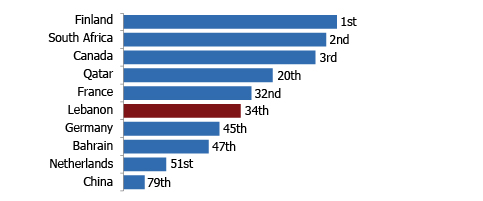

It has one of the most solid and safest banking systems, as reflected in the soundness of banks indicator, which is one of the highest in the world.

SOUNDNESS OF BANKS (2016)

Note: Standing among 138 countries. Ranking on the degree of soundness of financial institutions

Source: World Competitiveness Report 2016-2017

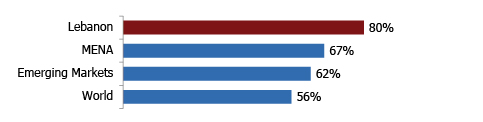

The Lebanese banking sector has traditionally maintained a high liquidity ratio, it is among the highest regionally and globally, and thus enabling the commercial banks to finance the government and private sector needs while maintaining a stable interest rate structure.

LIQUIDITY RATIO (2016)

Source: Bankdata Financial Services, IMF, Orbis Bank Focus, Fitch, MENA Central Banks

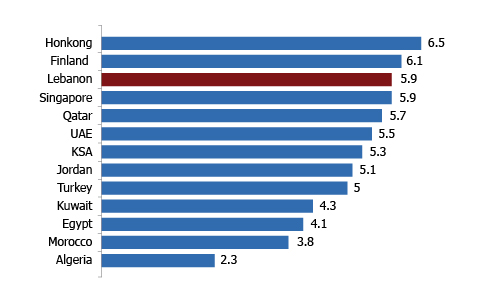

Furthermore, the absence of restrictions on capital flows, a main feature of our liberal financial system, is reflected in Lebanon’s leading position at par with developed countries such as Finland and Singapore.

RESTRICTIONS ON CAPITAL FLOWS (2010)

Notes:

* The index measures how restrictive the country’s regulations are in relation to the flow of interaction capital. 1=highly restrictive; 7=not restrictive at all

* This index has been removed from the global competitiveness report 2015 as this information is no longer collected

Source: World Economic Forum